URD 2021

-

Integrated Report

-

THE MEGATRENDS SHAPING THE FUTURE

To develop its mid- and long-term development strategy, Bureau Veritas carried out an in-depth study of its ecosystem. 5 STRUCTURAL TRENDS were identified as having an impact on its development. We came across the same fundamental reality at the heart of these megatrends, which have already taken root in every region in the world: a major need to reinstate trust between consumers/citizens, businesses, governments and society as a whole.

We have observed two global trends. The first is sustained demographic growth. The global population is expected to increase by 2 billion by 2050, taking the population from 7.7 to 9.7 billion people. The second is rapid urbanization. Around 55% of the global population live in urban areas. This percentage is set to increase to 70% in 2050. Asia and Africa will account for a large amount of this urban population growth.

To cope with this demographic increase, cities and states must make significant investments in transportation, housing, tertiary sector buildings and aging infrastructure renovation. In a post-Covid-19 world, these investments will help kick-start responsible economic recovery. More generally, demographic growth, notably the emergence of middle classes in developing countries, gives rise to greater expectations in terms of quality, safety and the guarantee of performance and sustainability.

OF THE GLOBAL POPULATION

will be urban by 2050,

and more than half of the global population

will live in Asia in 2050Supply chains have become increasingly complex as a result of the globalization of the economy over the last few decades. We have seen growing numbers of suppliers and intermediaries and a reduction in visibility at each stage and process in the supply chain. The Covid- 19 pandemic highlighted these fragilities and the increased need for transparency. Not merely transparency regarding the origin and quality of products, but also their impact on health, society and the environment. Certain balances have been upset. Manufacturers are increasingly turning their attention away from China and toward Southeast Asia. We have also seen an uptick in nearshoring, close to end markets. For example, some businesses are relocating operations to Mexico to serve the North American market. This reconfiguration creates new requirements, notably the need for local hubs that can propose testing, inspection and certification services as near as possible to the production sites.

Big Data reinforces the need for quality and flexibility within digital infrastructures. As the amount of data increases, it becomes more complicated to safely manage that data. The digitalization of the economy has made the security of systems and data sharing, as well as data protection, crucial for stakeholders. Cybersecurity regulations, by contrast, remain in their infancy. A fundamental switch from the Big Data era to the Right Data era is currently underway. Within the mass of information available, the main challenge is finding the correct, necessary and sufficient information to analyze a given situation. This means that data quality must be analyzed as soon as possible. It also reinforces the role of trusted third parties capable of validating the accuracy of the data. Bureau Veritas is using data analytics, machine learning and blockchain technologies to make its services more efficient and precise, while improving productivity and reliability. The Internet of Things (IoT) is on track to increase its value by 13% a year by 2024. This enormous growth is encouraging Bureau Veritas to develop its expertise and testing capacity in key markets by conducting regulatory and performance tests to ensure the integrity of data transmissions.

People today expect businesses to assume responsibility and play a role in tackling major social and environmental issues. Businesses committed to transitioning to sustainable models are realizing they need to be guided by an independent and impartial expert, to help them promote their efforts to be more responsible in a secure and transparent way. Additionally, businesses offering new services and technologies need testing, inspection and certification services in order to comply with new regulations. This is particularly pertinent to those in the green energy market, for example hydrogen, wind and solar energy.

The importance of healthcare challenges, and the need to reinforce hospital infrastructures and continue developing structures dedicated to helping the aging population, have been emphasized in recent years. Digitalization also impacts the healthcare sector, and has resulted in an increase in connected medical devices. Finally, the priority for all businesses is to provide adequate health, safety and hygiene conditions for their employees and clients. In order to reassure their clients and users and protect their employees’ health, they must guarantee that all hygiene measures are in place, both on operational sites and in offices.

-

BUREAU VERITAS, SHAPING A PATHWAY OF TRUST

-

A MESSAGE FROM ALDO CARDOSO, CHAIRMAN OF THE BOARD OF DIRECTORS OF BUREAU VERITAS

“Bureau Veritas has extraordinary potential for development and great

impact over the next few years.”In a world still impacted by the pandemic, I would like to pay tribute to tireless efforts made by our 80,000 employees around the world. They have not only protected our business fundamentals, and also they have ensured the continuing health and safety of each other, as well as that of our clients. We have put everything in place to continue running our business under the most optimal conditions while preparing the Group’s future and helping our clients deal with their challenges. Bureau Veritas’ employees managed to navigate these unprecedented times, united by their shared values, their convictions, and their remarkable professionalism.

The transformation of the Group and its business model has launched a new era for Bureau Veritas’ development. The company is much more resilient. Its fundamentals are more solid. Its team of experts is completely devoted to delivering efficiency and excellence to their 400,000 clients around the world. Bureau Veritas boasts strong organic growth, a robust operating margin, a healthy cash flow, and its lowest recorded financial debt. In a still-restrictive context, the company has achieved an excellent performance. Therefore, during the Annual Shareholders’ Meeting, the Board of Directors will propose a dividend payment of €0.53 per share to its shareholders, which represents an increase of 47% compared to 2020.

The Board of Directors welcomes new members as existing mandates come to an end. Other Board members have supported the company for many years. This enables the Board to mix agility with the stability that comes with long-term management. In this way, we can protect the company, supporting multi-year initiatives, and remaining committed to investments that are necessary for growth. In 2021, the members of the Board of Directors worked on numerous projects within the different committees. Foremost among these projects were: 2025 Strategic Direction supervision, the roadmap of risks linked to compliance, and succession planning for the executive functions of the Group. The transparency of this governance ensures that all our stakeholders’ interests are safeguarded. It ultimately secures the company’s stability.

Bureau Veritas has extraordinary potential for development and great impact over the next few years. Firstly, the size and fragmentation of the market offer huge growth possibilities. This is true in our established markets where we have a strong presence. It is also true for our newer markets, which are emerging as a result of the energy transition, the disruption of supply chains, and the increasing digitization of commerce. Secondly, our position as an independent third-party expert has become a cornerstone of the global chain of trust. This trust, which is at the heart of our company’s purpose, is also one of our strongest values feeding our long-term growth.

At Bureau Veritas, the Board of Directors is particularly invested in responsible and ethical business practices, as well as in all commitments that the company has adopted and will adopt in the future as part of its CSR policy. These topics are at the heart of society’s aspirations and the very essence of the Group’s expertise: the Board’s members consider it essential to protect social, human and natural capitals. They guide and supervise the Group’s decisions on the path toward sustainability. We owe this commitment to our stakeholders, and we owe it to ourselves.

-

A CONVERSATION WITH DIDIER MICHAUD - DANIEL, CHIEF EXECUTIVE OFFICER

BUREAU VERITAS HAS UNDERGONE A MAJOR TRANSFORMATION IN RECENT YEARS. IN YOUR OPINION, WHAT HAVE BEEN THE MAIN STEPS IN THIS EVOLUTION?

Indeed, Bureau Veritas has substantially changed over the last few years, even if the solid nature of the company remains based on its fundamentals, and on the strengths it has built up over the decades. First of all, we have made internal changes to the way we manage our business. By strengthening our governance and processes in terms of human resources, monitoring of operations and performance, we have entered a new era that positions Bureau Veritas among the world’s leading companies.

We have also modernized our reporting, talent management and collaborative work systems, as well as our tools to improve efficiency in the field. This is particularly true for tools used in our laboratories, and for sales performance monitoring and improvement. We are also undergoing cultural transformation, with greater diversity in our talent. This enables us to respond even more effectively to the challenges facing our clients and society in general. In addition to nurturing our technical and technological expertise, we have strengthened our teams with sales professionals with a view to becoming even more relevant to our clients. And beyond diversity, we are also focusing on inclusion: more systematic inclusion of women in operational and management positions, and inclusion of people with disabilities, regardless of their origin or age.

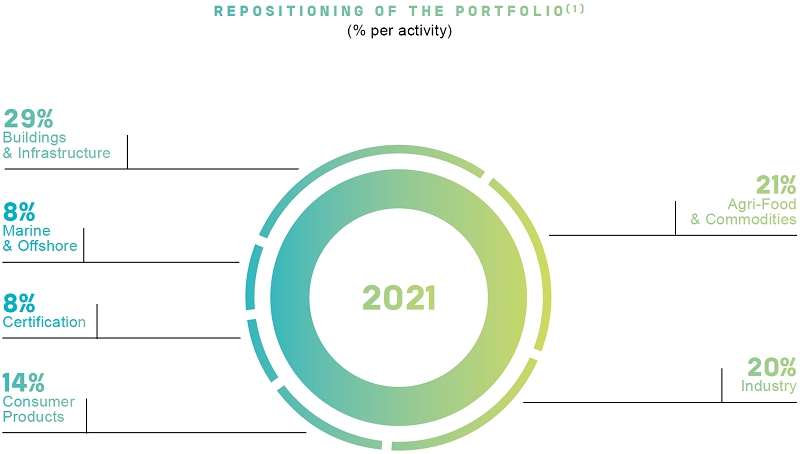

Finally, our transformation has also significantly changed our growth profile: we are now a more diversified company because we are stronger in new and booming markets such as construction, infrastructure, renewable energies, new forms of mobility and agri-food. We are in a leadership position to address the CSR challenges of our clients around the world. We have also strengthened our presence in certain areas of the world such as China and Asia in general, Latin America and Africa, while maintaining a dominant position in our historical regions.

Aliatou, we can be proud of what we have achieved together. It opens up considerable prospects for development and positive future impact.

BUREAU VERITAS HAS CLEAR AMBITIONS FOR THE FUTURE. HOW DO YOU SEE THE NEXT FEW YEARS UNFOLDING? AND HOW DO YOU SEE THE GROUP DEVELOPING?

To see the future, it is essential to take stock of who we are today. For two centuries, we have supported our clients in their efforts to better manage and reduce risks in terms of health, safety, quality, environmental protection and human rights. When we think about it, nothing is more modern or critical in today’s society! So yes, we harbor great ambitions for Bureau Veritas and especially for our 80,000 employees around the world who work every day to shape the fundamentals of trust that are needed for our society to function. Their work addresses challenges that are at the heart of our DNA, and also challenges linked to the new trends that we are accompanying. What I see for Bureau Veritas in the coming years is precisely this dual picture. On the one hand, this means gaining leadership positions in activities and sectors that represent our core expertise. On the other hand, it means taking an even more innovative, proactive and agile approach by analyzing our clients’ future challenges and adapting our services to support them on new paths._______ ›

Our 2025 strategy is therefore based on three pillars. The first, “Scale,” will consist of creating value through organic growth, in particular by accelerating replication of our products and services, and improving our operational performance. With the second, “Expand,” we will capitalize on our know-how to penetrate adjacent markets such as renewable energies. With the third, “Lead,” we will sow the seeds of the future, taking full advantage of technological evolutions, positioning ourselves for future changes and investing in areas that could be the core of our business in the future. At the same time, our BV Green Line, which today accounts for more than 50% of our sales, has strong growth potential and is part of our stated desire to support our clients in achieving greater transparency and credibility in their CSR commitments. Our common culture, strong governance, capacity for innovation and the power of our brand will be critical catalysts for our development as well as for the commitment of our teams to serve our clients, shareholders and society as a whole.

“I am convinced of the relevance of our corporate mission, which is to Shape a World of Trust by ensuring responsible progress. This is the virtuous loop of a Business to Business to Society company.”

ONE OF BUREAU VERITAS’ MAIN CHALLENGES IS RECRUITMENT. TODAY WE HAVE 80,000 TRUST MAKERS – IN THE VERY NEAR FUTURE, THERE WILL BE 90,000 OR 100,000. WHICH ADVICE WOULD YOU GIVE TO AN HR MANAGER OR A LEADER TO ATTRACT NEW TALENT?

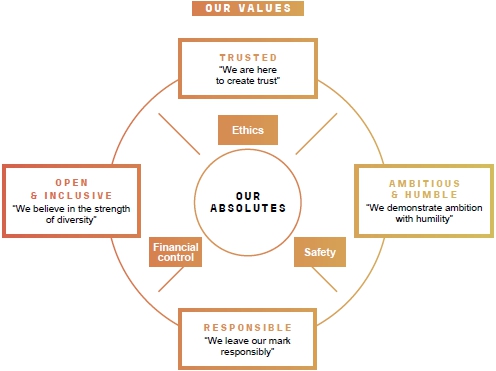

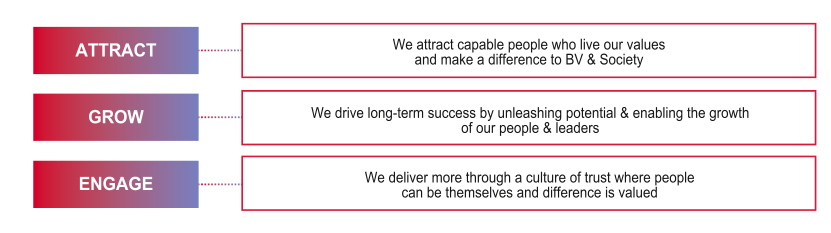

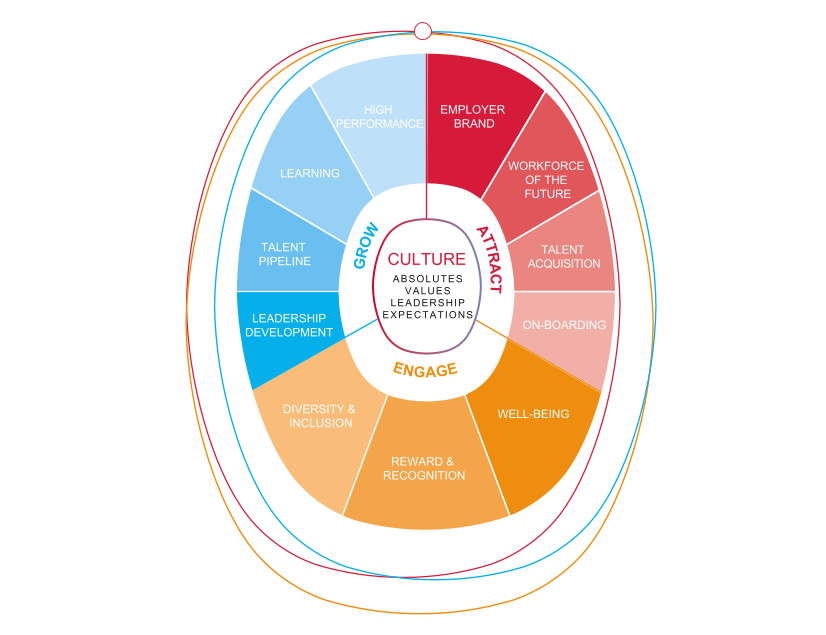

For a services group like Bureau Veritas, present in 140 countries and employing around 80,000 people, nothing is more valuable than human capital: it is this perfect combination of our employees’ expertise and commitment that makes Bureau Veritas a company like no other. What are today’s talents looking for when they consider joining a new company? The pursuit of meaning, and a sense they are making a real contribution and a positive impact. Are there many companies in the world whose mission is more relevant to society’s challenges, and more valuable than ours? Shaping a World of Trust around sustainability topics! What could be more rewarding than knowing that every day, through your work, you will have a positive impact on the lives of millions of people? Every year, we recruit more than 10,000 new talents. In joining Bureau Veritas, they are certain that they can leave their mark, while embodying our values: Trusted, Responsible, Ambitious & Humble and Open & Inclusive. This is what it means to be a BV Trust Maker. To become real, this promise – this conviction – must be backed up by concrete actions. What we offer our clients, we impose on ourselves with the utmost rigor. Through the “Shaping a Better Workplace” pillar of our CSR strategy, we are doing everything we can to foster an environment that is conducive to trust and development – notably by promoting inclusion, gender equality, respect for the environment and the promotion of a fair and ethical ecosystem. We have set ourselves ambitious goals for 2025 in this regard. These include offering a large amount of training for all our employees – 35 hours per person – and ensuring that 35% of executive leadership positions are held by women. Of course, we will continue to make Ethics, Safety and Financial Control our Absolutes. They are the pillars of our shared culture.

ON THE GROUND, I SEE BOTH INCREASED AGILITY AND RESILIENCE. CAN YOU SUMMARIZE HOW THIS HAS BEEN DEMONSTRATED ACROSS THE GROUP?

Indeed, in this unprecedented period, our people have shown remarkable agility and resilience. By maintaining momentum across our business, remaining committed to our clients, and accelerating in ways we had already begun, they have enabled the company to weather the crisis and emerge even stronger than before. I am extremely grateful to them. For while this crisis has confirmed the resilience of our business model – supported by the diversification we have undertaken since 2015 – it has also been a catalyst for issues such as health and hygiene, digitalization, supply chain management and sustainable development. A catalyst, if not an accelerator: more than ever, our clients depend on us, our expertise, our impartiality and our independence, to provide tangible proof of their commitments and create a basis for trust with their own clients. In addition, we have been able to offer new and innovative services – such as remote inspections – that have enabled on-site activities to continue. We have also implemented digital platforms for better supply chain traceability. Thanks to the energy of the men and women of Bureau Veritas, the Group has remained strong. Their commitment is a key enabler as we put our 2025 Strategic Direction into practice. I would also like to underline the unfailing support of our shareholders throughout this period: they are an essential cornerstone of our success, today and tomorrow.

INTUITIVELY, I UNDERSTAND WHAT BTOBTOS IS, BUT IN PRACTICAL TERMS, WHAT DOES IT MEAN FOR US AND OUR CLIENTS?

Thank you for asking this relevant question, Rajiv. Being a Business to Business to Society company relies on three fundamental pillars. First, it means putting our clients at the heart of our mission. The very nature of our business gives us a unique positioning: we operate at the interface between companies and decision makers on the one hand, and citizens and consumers on the other. We build a bridge between the objectives of the former and the aspirations of the latter, with the ultimate goal of a positive impact for all. Second, being a BtoBtoS company means acting with humility when faced with the challenges of each era. Our two centuries of experience and our multi-sector expertise enable us to gauge the issues that companies face today in combining growth with a positive impact on society and the environment. Sometimes, depending on the sector and the nature of the business, changes toward more sustainable and virtuous models take time. It is also our role to support these transitions and to act where the shifts are the most complex. Finally, it means regarding human capital as our most valuable asset. It means creating a work environment conducive to trust and to the development of everyone. It means acting responsibly and sustainably everywhere in the world ourselves. It means fostering inclusion, gender equality and the promotion of a just and ethical ecosystem. It also means creating, through human endeavor, the right conditions for a common ambition: to leave a positive mark on the world we live in via projects that everyone can contribute toward. In this way, we can ensure that the company’s values are fully expressed. Companies now have a duty of citizenship and a societal mission that goes beyond their core business. We are here to support them, with independence and impartiality, in their desire to combine growth with a positive impact on society and the environment. I am convinced of the relevance of our corporate mission, which is to Shape a World of Trust by ensuring responsible progress. This is the virtuous loop of a Business to Business to Society company. _

-

SHARE

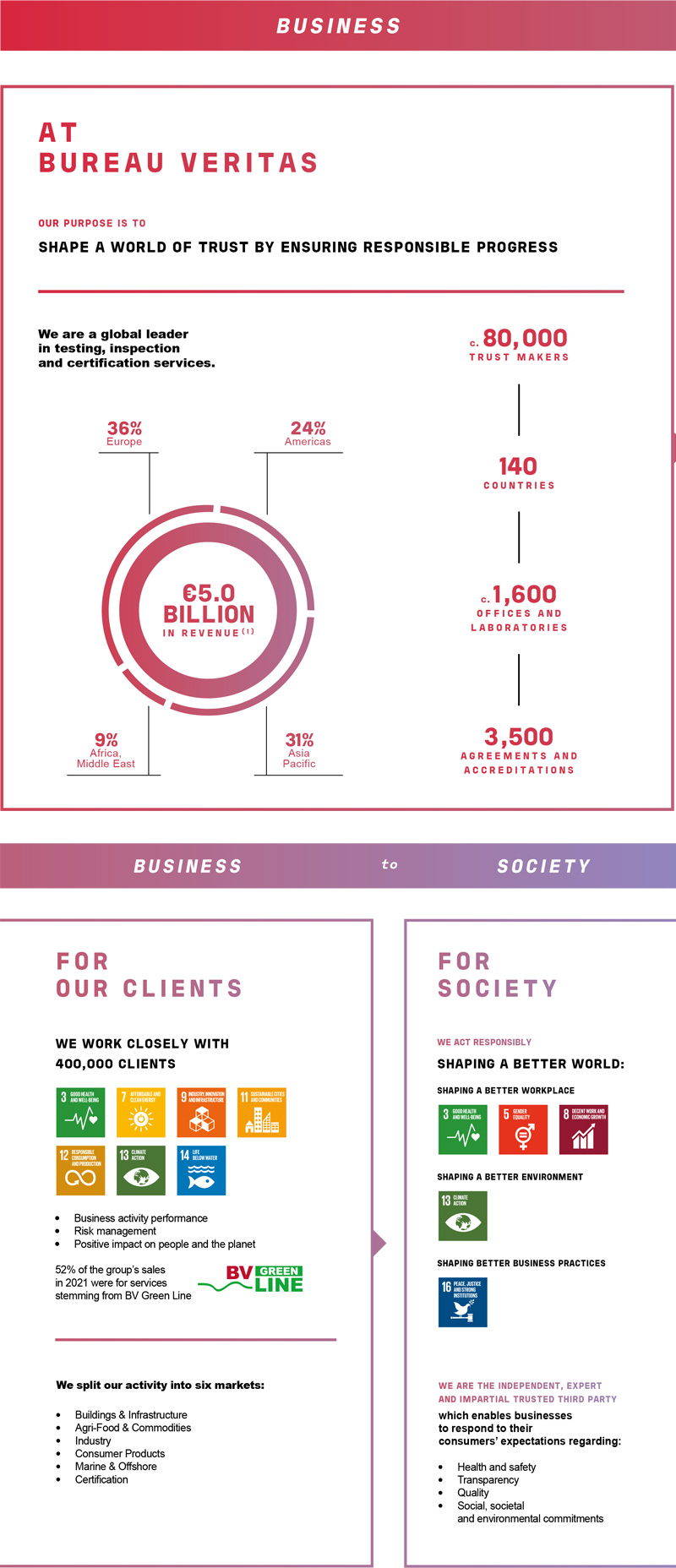

For Bureau Veritas, progress only makes sense when it is responsible and inclusive. The Group is therefore committed to helping its stakeholders and value chain partners take this approach, considering that responsible progress is the fundamental bedrock for Shaping a World of Trust.

OUR MISSION AND PURPOSE

The Group has been shaping trust between businesses, governments and society since 1828, by acting as an independent, expert and impartial guarantor of its clients’ word. The Group’s employees are focus on clients and driven by society. They ensure that Bureau Veritas is a Business to Business to Society company that contributes to positively transforming the world we live.

Bureau Veritas has placed its purpose at the heart of its business model for its employees, clients, partners, shareholders and society as a whole. What does that mean in concrete terms?

The very nature of our business gives us a unique positioning: we operate at the interface between companies and decision makers on the one hand, and citizens and consumers on the other. We build a bridge between the objectives of the former and the aspirations of the latter, with the ultimate goal of a positive impact for all.

Our two centuries of experience and our multi-sector expertise enable us to gauge the issues that companies face today in combining growth with a positive impact on society and the environment. Sometimes, depending on the sector and the nature of the business, changes towards more sustainable and virtuous models take time. It is also our role to support these transitions and to act where the shifts are the most complex.

It means creating a work environment conducive to trust and to the development of everyone. It means acting responsibly and sustainably everywhere in the world ourselves. It means fostering inclusion, gender equality and the promotion of a just and ethical ecosystem. It also means creating, through human endeavor, the right conditions for a common ambition: to leave a positive mark on the world we live in via projects that everyone can contribute toward. In this way, we can ensure that the company’s values are fully expressed.

Bureau Veritas’ 80,000 employees work in 140 countries and in almost all sectors of the economy. Wherever the Group is situated, Bureau Veritas cultivates an open-minded and inclusive environment. Ethics, Safety and Financial control are our Absolutes. These three Absolutes are prerequisites for the business, without which Bureau Veritas employees could not carry out their jobs. The Group’s employer brand, centered around the motto “Leave Your Mark,” was drafted in alignment with the fundamentals of the Group’s purpose. Bureau Veritas employees are guardians of integrity and act as entrepreneurs, with ambition and high standards.

They shape trust between companies and their stakeholders by striving for excellence and independence.

upon which relationships between citizens, public authorities, and companies are built. In today’s fast-changing world, this essential link is not a given.

• Citizens and clients are seeking out verified and verifiable information on how companies develop, produce and supply their goods and services. Decision makers across all organizations face the challenge of proving their CSR commitments in order to remain competitive and sustainable. • At Bureau Veritas, our work enables organizations to operate and innovate safely and perform better. Thanks to our unrivaled expertise, technical knowledge and worldwide presence, we support them by managing quality, safety and sustainability risks, to the benefit of society as a whole. • As a Business to Business to Society company, we believe that, today more than ever, trust depends on evidence of responsible progress. • We bring more to the table than testing, inspection and certification. The work we do goes beyond verifying compliance and has a much wider impact. • Since 1828, we have acted as Trust Makers between companies, governments and society, and independent, impartial guarantors of our clients’ word. • We play a pivotal role in building and protecting companies’ reputations, supporting them as they forge the foundations of trust that is built to last. -

ACCELERATE

As a global leader at the heart of economic and social issues, Bureau Veritas has a dual development model that is both sustainable and responsible. This model serves both its development ambitions and its convictions, its commitment to having a positive impact on people and the planet, and the expectations of its stakeholders. It is a forward-looking model, which creates value for all.

OUR STRENGTH: A REINFORCED GROWTH PROFILE

For Bureau Veritas, 2015 to 2020 was a period of profound transformation. The Group emerged from this strategic plan more diverse, more resilient, more efficient, more robust and more digital.

To strengthen its resilience and create growth platforms, the Group re-worked its portfolio of activities, pivoting its business model toward key markets and services that are less subject to cyclical changes. One of the main objectives of the 2015-2020 strategic plan was to diversify its businesses and to move toward markets shaped by urbanization and consumerism. In construction and infrastructure, we developed new platforms in China, Latin America, the United States and Southeast Asia while maintaining our already strong position in Europe. During this period, Bureau Veritas developed a leading position in the agri-food market, particularly in Asia – where a large percentage of the world population lives – thanks to a new hub in Singapore as well as one in Latin America. In the Oil & Gas sector, the Group strengthened its presence in Opex services. Finally, the business leveraged opportunities linked to the rapid development of the Internet of Things. We considerably strengthened our expertise and geographical presence to respond to the increased need for testing this equipment, and for developing new services surrounding connectivity and data security. With this dual diversification, both within sectors and geographically, Bureau Veritas opted for a more balanced and long-lasting growth.

The Group, a world leader after two decades of strong external growth, focused on strengthening its managerial teams, adapting its processes and modernizing its tools. This transformation was carried out in various ways:

• Executive Committee renewal. Now more inclusive and international, the Committee is made up of diversified expertise – mirroring the Group’s image –united by a common vision. • An emphasis on enhancing business culture, and highlighting the importance of understanding challenges and identifying client needs. • Implementation of a robust management system aligned with the best international standards. The system is adapted to Bureau Veritas’ decentralized management structure to drive our major business programs. These include performance management, talent management, governance monitoring, and decision-making for mergers/acquisitions and investments. The business’s expertise surrounding new technologies greatly increased during the last two years of the strategic plan, which highlighted 3 priorities:

• Increasing efficiency, mainly with the use of digital tools in various sectors: BIM* in construction and infrastructure, drone inspections in the marine and offshore, agri-food and industrial sectors, etc. • Designing new digital services, for example in cybersecurity. • Developing digital platforms on our clients’ behalf. The structure of the portfolio is now more resilient, thanks to the rebalancing between the Capex services (investment phase relating to design and construction), Opex & Management Systems and Products. The Opex segment, consisting of recurring contracts mainly related to regulations and standards, offers long-term visibility and helps build client loyalty.

-

CREATE

To put our 2025 Strategic Direction into action, and reach our ambition, we rely on solid fundamentals. These include a robust governance — which provides impetus and ensures we successfully deploy our major strategic directions — and a business model that creates value.

OUR BOARD OF DIRECTORS

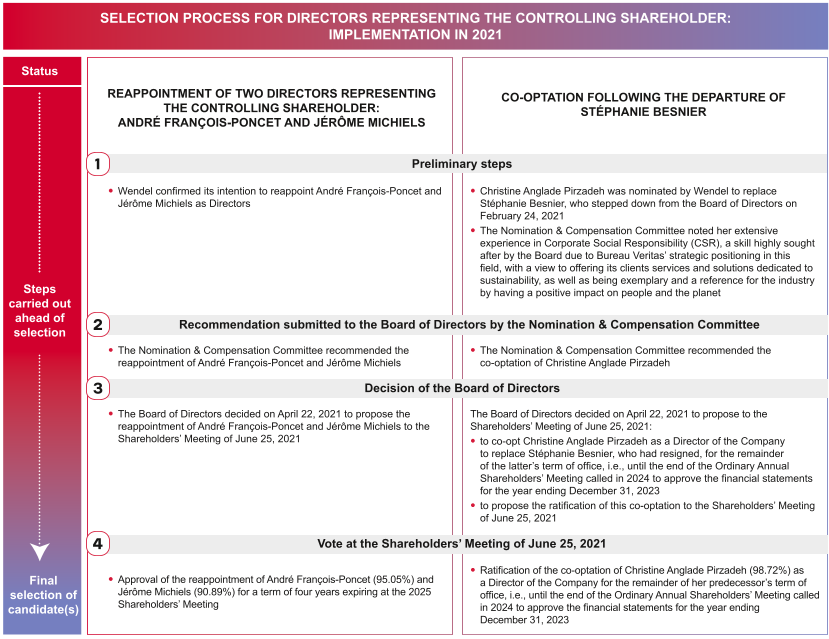

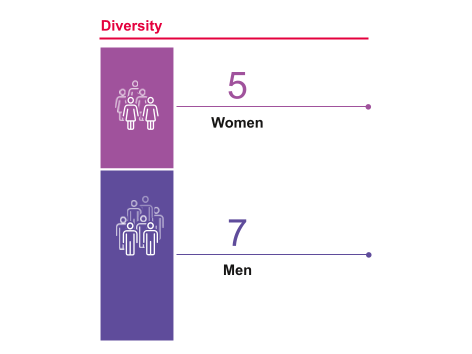

The Board of Directors believes that diversity within its Director selection process is of the utmost importance. Diversity fosters energy, creativity and performance and ensures that the Board’s debates and decisions are of the highest quality.

• Board member since 2009 and Chairman since 2017, Aldo Cardoso has held various positions at Arthur Andersen, including Chief Executive Officer of Andersen Worldwide (2002-2003). Aldo Cardoso is a graduate of the École supérieure de commerce de Paris, has a Master’s degree in Business Law and is a certified public accountant in France. He is a company director.

• A graduate of the École des Hautes Études Commerciales and holder of an MBA from Harvard Business School, André François-Poncet began his career in 1984 at Morgan Stanley in New York. He is currently CEO of the Wendel Group.

• A graduate of the École des Hautes Études Commerciales, Jérôme Michiels started his career as a consultant for Boston Consulting Group, then as Chargé d’affaires with the investment fund BC Partners. He joined Wendel at the end of 2006 and is now Deputy Managing Director, Associate Director, Financial Director and Director of Operational Resources of the Group. In 2020, he was appointed as a cybersecurity sponsor for Bureau Veritas.

• Having graduated with a Master’s degree in European and International Law (Paris I University) and a postgraduate degree in Communications Law (Paris II University), Christine Anglade Pirzadeh has been Director of Sustainable Development and Communication at Wendel since October 2011.

• Former Senior Partner at McKinsey & Company in France, specializing in high technology, advanced industries and talent/the workplace of the future, Julie Avrane is a graduate of the École Nationale Supérieure des Télécommunications de Paris and the Collège des Ingénieurs. She also holds an MBA (Master in Business Administration) from INSEAD.

• A graduate of the École des Hautes Études Commerciales, Claude Ehlinger joined Wendel in 2016 as Chief Executive Officer of Oranje-Nassau, Managing Director and a member of the Investment Committee. He has been Senior Advisor since 2019. He is Chairman and independent non-executive director of LCH SA (central clearing house).

British nationality Member of the Board of Directors, independent Chair of the Audit & Risk Committee

• With a Master of Arts in History from Oxford University and a Chartered Accountant certification in the United Kingdom, Siân Herbert-Jones began her career at PricewaterhouseCoopers before joining the Sodexo group in 1995. From 2001 to 2016, she served as Chief Financial Officer of Sodexo.

• A graduate of the Parisla Défense École Supérieure d’Architecture, Philippe Lazare has held leading management positions in major industrial and service groups: PSA, Sextant Avionics, Air France, Eurotunnel and La Poste. Having joined Ingenico Group in 2007, he was Chairman and Chief Executive Officer until November 2018. Since the end of 2018, he has been a company director.

• A graduate of the École des Hautes Études Commerciales du Nord, Pascal Lebard began his career as Business Manager at Crédit commercial de France before taking up management positions in various companies. In 2003, he joined Worms & Cie (which became Sequana in 2005) as a member of the Supervisory Board and as a member and then Chairman of the Executive Board (2004-2005). Between 2013 and 2021, he was Chairman and Chief Executive Officer of Sequana. He has been Chairman of Equerre Capital Partners since 2021.

• An engineer with degrees from the Polytechnic University Barcelona and from INSEAD business school in France, Ana Giros Calpe is Senior Executive Vice-President in charge of International, Infrastructure, Performance, and Research & Development at the Suez group and member of the Executive Committee.

• A graduate of the École des Hautes Études Commerciales, the Institut d’études politiques de Paris and holder of a post-graduate qualification in economics (DEA) from Paris-Dauphine University, Frédéric Sanchez began his career working at Renault in Mexico and subsequently the United States, before joining Ernst & Young in 1987 as a mission manager. In 1990, he joined the Fives-Lille group (renamed Fives in 2007). In 2002, he became Chairman of the Executive Board of the company.

• A graduate of the École Supérieure des Sciences Economiques et Commerciales, and Paris II – Panthéon Assas University (LLM, 1988), Lucia Sinapi-Thomas was admitted to the Paris bar and is a certified financial analyst. She started her career as a tax and business lawyer in 1986, before joining Capgemini in 1992. She is now Executive Director of Capgemini Ventures and a Board member at Capgemini SE.

-

1.1General overview of the Group

Mission

The Group’s mission is to reduce its clients’ risks, improve their performance and help them innovate to meet the challenges of quality, health and safety, and sustainable development. Leveraging its renowned expertise, as well as its impartiality, integrity and independence, Bureau Veritas has helped build trust between companies, public authorities and consumers for more than 190 years.

The services provided by Bureau Veritas are designed to ensure that products, assets and management systems conform to different standards and regulations in terms of quality, health, safety, environmental protection and social responsibility (“QHSE”).

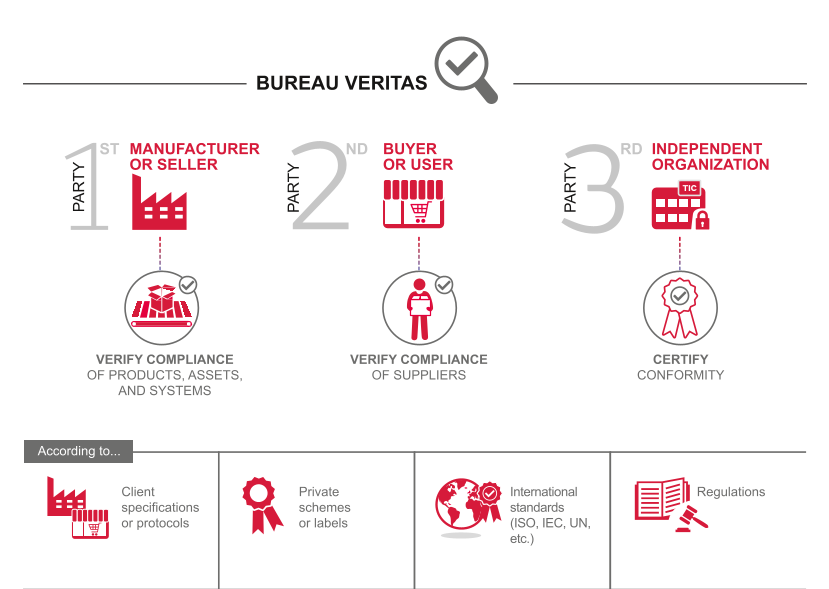

Depending on its clients’ needs and on applicable regulations, standards or contractual requirements, Bureau Veritas acts:

- ●as a “third party”, i.e., an independent body issuing reports and conformity certificates for products, assets, systems, services or organizations;

- ●as a “second party” on behalf of and upon the instructions of its clients to ensure better control of the supply chain; or

- ●as a “first party” on behalf of clients seeking to ensure that the products, assets, systems or services they are producing or selling meet the requisite standards.

Obtaining a license to operate

Companies must be able to show that they are compliant with a large number of standards and regulations. Bureau Veritas offers them its in-depth knowledge of the standards applicable to their businesses, and as an independent third party, is able to verify their compliance. This allows them to conduct and develop their businesses in compliance with local and international regulatory requirements and to obtain and renew the licenses to operate issued by public authorities.

Facilitating trade

International trade relies among other things on third-party players who certify that the goods exchanged comply with the quality and quantities stipulated in the contract between the parties. Bureau Veritas plays a role in the trade process by testing materials, verifying that goods comply with contractual specifications and validating quantities. Exchanges of commodities, for example, are based on certificates issued by companies such as Bureau Veritas.

Accessing global markets

Capital goods or mass consumer products must comply with national and supranational standards before being sold on the market in a given country. These standards constitute technical trade barriers within the meaning of the WTO. Companies design and manufacture their products and equipment to meet the standards of several countries. In doing so, they call on Bureau Veritas to carry out tests, optimize their test plan and ultimately reduce time-to-market.

Reducing risks

Managing risk in the areas of quality, health, safety, environment protection and social responsibility improves the efficiency and performance of organizations. Bureau Veritas helps its clients to identify and manage these risks, from project design to completion and decommissioning.

Keeping costs in check

Thanks to second- and third-party testing, inspection and auditing methods, companies can determine the actual condition of their assets and launch new projects and products safe in the knowledge that costs, timing and quality are under control. During the operational phase, inspections help optimize maintenance and the useful life of industrial equipment.

Protecting brands

The social network boom of recent years has prompted a fundamental change in how global brands are managed. Brands may quickly find themselves under fire due to the malfunction of one of the links in their supply or distribution chain. Bureau Veritas allows companies to improve their risk management, using analyses conducted by a highly reputed independent player.

-

1.2History

1828: Origins

The “Information Office for Maritime Insurance” was founded in Antwerp, Belgium, in 1828 to collect, verify and provide shipping underwriters with information on the condition of ships and equipment. Renamed Bureau Veritas, the Company transferred its registered office to Paris and built up an international network.

-

1.3The TIC industry

To the Group’s knowledge, there is no comprehensive report covering or dealing with the markets in which it operates. As a result, and unless otherwise stated, the information presented in this section reflects the Group’s estimates, which are provided for information purposes only and do not represent official data. The Group gives no assurance that a third party using other methods to collect, analyze or compile market data would obtain the same results. The Group’s competitors may also define these markets differently.

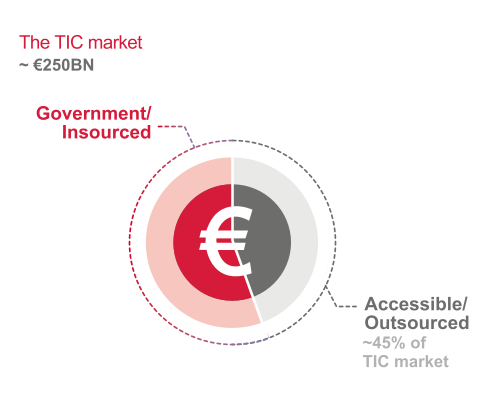

1.3.1A market estimated to be worth close to €250 billion

Inspection, certification and laboratory testing services in the areas of quality, safety, performance, and social and environmental responsibility are commonly referred to as Testing, Inspection and Certification (“TIC”). TIC services encompass several types of tasks, including laboratory or on-site testing, management process audits, documentary checks, inspections across the entire supply chain and data consistency verification. These activities may be carried out on behalf of the end user or purchaser, independently of stakeholders or at the request of the manufacturer, or on behalf of public or private authorities. TIC services are called for at every stage of the supply chain and apply across all industries.

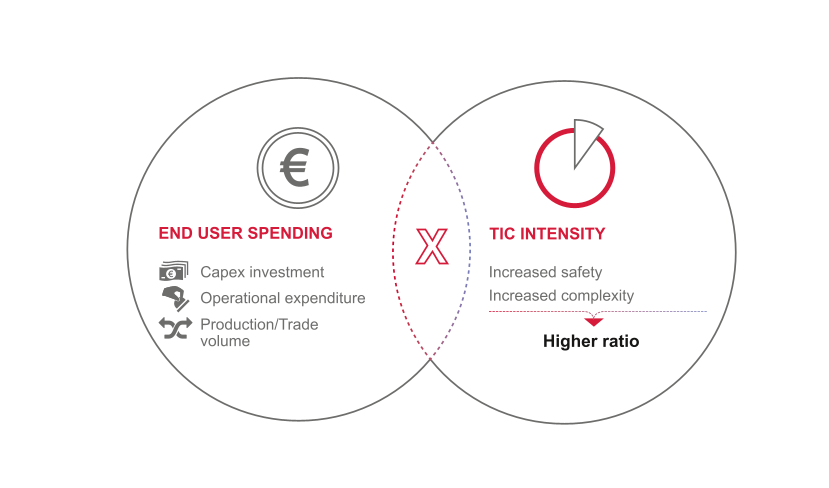

The overall TIC market depends on product and asset values and the associated risk. The TIC “intensity” corresponds to the proportion of the value of the product or asset allocated by the manufacturer of the product or the operator of the asset to control activities. In general, the TIC intensity falls within a range of between 0.1% and 0.8% of the value of the product or asset. The total estimated value of the TIC market can be calculated by multiplying the TIC intensity by the amount spent by manufacturers, operators, and the buyers and sellers of goods and products.

On a short- and medium-term basis, the size of the market mainly varies in relation to inflation, global economic activity, investment and international trade. Applying the aforementioned approach, Bureau Veritas estimated the size of the global TIC market in 2021 at close to €250 billion, based on external macroeconomic data such as investment volume per market, operational spending per market, the production value of goods and services, and the level of imports and exports.

- ●the accessible (outsourced) market, where services are provided by specialized private organizations or firms, such as Bureau Veritas;

- ●the internal (insourced) market, where the companies themselves perform these services as part of quality control and assurance; along with the market served by public bodies and organizations such as customs, competition authorities, port authorities or industrial health and safety authorities.

The outsourced TIC market also depends on a country’s administrative organization, whether or not it has a federal structure, and the industry concerned. Over time, these factors may have a significant impact on the size of the market, irrespective of the underlying macroeconomic conditions. The balance between insourcing and outsourcing therefore fluctuates from year to year, depending on the policies implemented by governments or changes in practices within industry sectors. This is the case in China, for example, where certain sectors are opening up gradually.

- ●end-user expenditure;

- ●the TIC “intensity” of products (fairly stable in the short term but may increase in the long term due to stricter standards and regulations);

- ●the extent to which businesses subcontract these services (the trend shows that this is increasing).

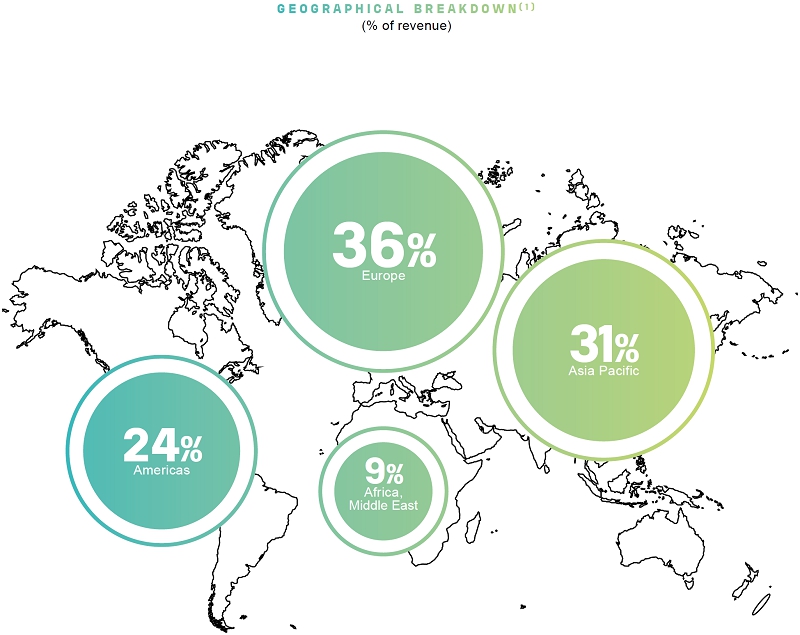

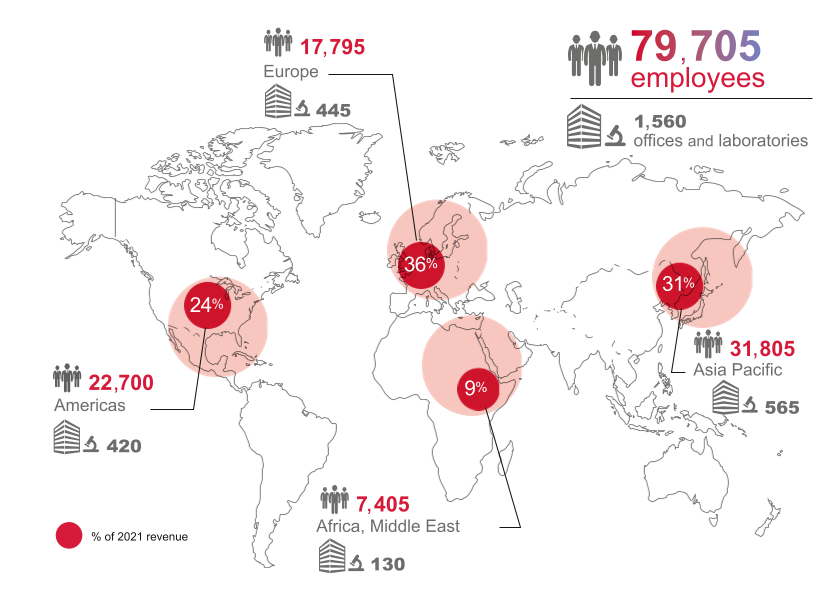

From a geographical point of view, the TIC market can be split into three main regions: Europe, the Americas and Asia. Bureau Veritas is present in all of these regions thanks to the investments it has made over the past 15 years. Going forward, the Group plans to bolster its positioning, particularly in the fastest-growing markets such as China and the United States.

-

1.4Strategy and objectives

1.4.1Key competitive advantages

An efficient international network

Bureau Veritas has an extensive global network of around 1,600 offices and laboratories in almost 140 countries.

This network is particularly well developed in countries with mature economies (e.g., France, the United States, Canada, Japan, the United Kingdom, Spain, Italy, the Netherlands, Australia and South Korea), which have a strong regulatory background and where the Group is recognized for its technical expertise and innovative production models.

Bureau Veritas is also well established in faster growing economies like China, Brazil, Chile, Colombia, the United Arab Emirates and India, where it has built solid growth platforms with a strong local presence over time. The Group continues to expand its exposure to these regions by opening new offices and laboratories and systematically developing each of its businesses in these markets.

The Group’s scale is one of its core assets, providing value and differentiation both commercially and operationally.

From a sales standpoint, its global network enables the Group to service key accounts (around one-quarter of the Group’s revenue) and thereby win major international contracts, which represent a growing part of its activity.

From an operational standpoint, the Group improves its profitability by generating economies of scale resulting in particular from sharing offices, back-office functions and IT tools, and from amortizing the cost of developing and replicating new services and industrializing inspection processes over a larger base.

The organization into regional hubs located in key countries enables the Group to spread knowledge, technical support and sales teams across a given region.

In the future, the Group aims to strengthen this network organization around regional hubs, enabling it to generate scale effects.

A strong brand image of technical expertise and integrity

Bureau Veritas has built a successful global business based on its long-standing reputation for technical expertise, high quality and integrity. This reputation is one of its most valuable assets and is a competitive advantage for the Group worldwide.

Technical expertise recognized by the authorities and by many accreditation bodies

Over the years, the Group has acquired skills and know-how in a large number of technical fields, as well as broad knowledge of regulatory environments. Bureau Veritas is currently accredited as a second or third party by a large number of national and international delegating authorities and accreditation bodies. The Group constantly seeks to maintain, renew and extend its portfolio of accreditations and authorizations. It is subject to regular checks and audits by authorities and accreditation bodies to ensure that its procedures, the level of qualification of its personnel and its management systems comply with the requisite standards, norms, guidelines or regulations.

Quality and integrity embedded in the Group’s culture and processes

Integrity, ethics, impartiality and independence are some of Bureau Veritas’ core values and are central to its brand reputation and the value proposition for its clients.

These values are the focal point of the work carried out by the TIC profession in 2003 under the leadership of the TIC Council (the international association representing independent testing, inspection and certification companies), which led to the drafting of the Group’s first Code of Ethics, published in October 2003.

A profitable growth model supported by strong cash generation

- ●it is based on two growth drivers: primarily organic growth, supported by growth through acquisitions. Average organic growth over the past five years (including a 6.0% decline in 2020 in the context of the crisis caused by the Covid-19 pandemic) was around 3%;

- ●it is a profitable growth model, with a high adjusted operating margin. Historically, it is slightly above 16% on average;

- ●it generates significant and regular cash flow: the Group’s free cash flow has averaged around €540 million over the last five years. It should be noted that Bureau Veritas has paid very close attention to its cash flow and liquidity – particularly in terms of its working capital requirements – especially in recent years. These efforts have been stepped up in the context of the health crisis;

- ●it is underpinned by the Group’s strategy of strict capital allocation: net debt must be maintained well below bank ratios and the Group must be able to fund acquisitions and pay dividends.

-

1.5Presentation of business activities

1.5.1Marine & Offshore

Group revenue

Group Adjusted Operating Profit

A portfolio of high value-added services for a loyal client base

Bureau Veritas classifies ships and offshore facilities by verifying their compliance with classification rules, mainly regarding structural soundness and the reliability of all related equipment. This mission is usually carried out together with the regulatory (“statutory”) certification mission.

Class and regulatory certificates are essential for operating ships. Maritime insurance companies require such certificates to provide coverage, and port authorities regularly check that valid certificates exist when ships come into port. Similarly, keeping existing offshore facilities in compliance with safety and quality standards, as well as regulatory requirements is crucial for operators.

Marine & Offshore services are designed to help clients comply with regulations, reduce risk, and increase asset lifecycles while protecting the marine environment. The Group’s services begin at the construction phase, approving drawings, inspecting materials and equipment, and surveying at the shipyard. During the operational life of the assets, Marine & Offshore experts make regular inspections and offer a comprehensive range of technical services including asset integrity management. On behalf of its clients, Bureau Veritas monitors any changes in regulations, identifies applicable standards, manages the compliance process, reviews design and execution and liaises with the competent authorities.

The Group has also diversified into several complementary services, including loss adjusting and risk assessment for the offshore industry (acquisition of MatthewsDaniel in 2014) and marine accident investigations, pre-and post-salvage advice and the re-floating of vessels (acquisition of TMC Marine Ltd. in 2016). It also created Bureau Veritas Solutions Marine & Offshore in 2018.

In 2021, 40% of Marine & Offshore revenue was generated by the classification and certification of ships under construction and 60% was generated by the surveillance of ships in service and complementary services.

The Group is a member of the International Association of Classification Societies (IACS), which brings together the 12 largest international classification societies. They classify more than 90% of world tonnage, with the remaining fleet either not classified or classified by small classification companies operating mainly at the national level.

Worldwide network

To meet the needs of its clients, the Marine & Offshore network spans 90 countries. In addition to 18 local design approval offices located near its clients, the Group’s network of 180 control stations gives it access to qualified surveyors in the world’s largest ports. This means that inspections can be conducted on demand and without the delays that could be detrimental to the ship’s business and owner.

A highly diverse fleet classed by Bureau Veritas

Bureau Veritas ranks number one worldwide in terms of the number of classed ships and number six worldwide in terms of tonnage. The Group has recognized technical expertise in all segments of maritime transport (bulk carriers, oil and chemical tankers, container ships, gas carriers, passenger ships, warships and tugs) and offshore facilities for the exploration and development of both coastal and deep-water oil and gas fields (fixed and floating platforms, offshore support vessels, drill ships, subsea facilities). The fleet classed by Bureau Veritas is highly diverse, and the Group holds a leading position in the market for highly technical ships such as liquefied natural gas (LNG)-fueled vessels, LNG or liquefied petroleum gas (LPG) carriers, FPSO/FSO floating production systems, offshore oil platforms, cruise ships, ferries, and specialized ships.

A diversified and loyal client base

The Group has several thousands of clients, and the largest represents 0.9% of the business segment’s revenue. Key clients are:

- ●shipyards and shipbuilders around the world;

- ●equipment and component manufacturers;

- ●ship owners;

- ●oil companies and Engineering, Procurement, Installation and Commissioning (EPIC) contractors involved in the construction and operation of offshore production units;

- ●insurance companies, P&I clubs(9) and lawyers.

Changes in the order book

Changes in the Group’s in-service fleet

A changing market

A changing regulatory environment

International regulations applicable to maritime safety and environmental protection continue to evolve, providing classification companies with growth opportunities. These include:

- ●new regulations to reduce greenhouse gas emissions for new and existing ships in accordance with the international conventions adopted under the aegis of the International Maritime Organization (IMO) and the European Union. To respond to these regulatory requirements and to help ship owners in their energy transition, Bureau Veritas has developed a range of dedicated services and tools. The upcoming adoption of emissions reduction goals for existing ships opens up a wide spectrum of new activities for Bureau Veritas targeting in-service fleets that will have to comply with an energy performance improvement trajectory starting in 2023;

- ●the publication by the European Commission in July 2021 of a series of measures known as the “Fit for 55” package, a milestone in the environmental transition of the freight transport industry. “Fit for 55” sets out a roadmap for achieving the European Union’s stated ambition of a 55% reduction in greenhouse gases by 2030. One of the main measures concerning shipping consists of bringing it into the emissions trading system (EU ETS). This market-based approach to reducing GHG intensity through a market instrument is rounded out by a technical measure known as FuelEU Maritime, which requires (i) ships to improve their energy efficiency by 2050 through the use of cleaner fuels and (ii) passenger lines and container ships to use on-shore power when in port as from 2030;

- ●the 2004 convention on Ballast Water Management (BWM) adopted under the aegis of the IMO, which makes it mandatory to obtain approval for ballast water treatment systems and imposes changes in ship design. These regulations came into force in September 2017 and have since been the object of various implementation measures, giving classification societies a greater role in verifying the effectiveness of ballast water management systems in various configurations, once installed on-board;

- ●the Hong Kong international convention on ship recycling, which was adopted in May 2009 and will come into force 24 months after it has been ratified by 15 countries. This should represent at least 40% of the gross tonnage of the global merchant vessel fleet;

- ●the European Ship Recycling Regulation, which came into force at the end of 2018 for new ships and as from January 1, 2021 for existing ships and those flying the flag of a non-Member State. The regulation requires ships to have on board a certified inventory of hazardous materials (IHM);

- ●regulations applicable to ships for inland navigation transporting hazardous materials. Bureau Veritas is one of three classification societies recognized by the European Union;

- ●the new International Association of Classification Societies (IACS) unified requirement concerning on-board use and application of computer-based systems, which came into force on July 1, 2016. This has since been rounded out by the Recommendation on Cyber Resilience. This issue is becoming ever more important given the corresponding increase in cyber risk, and has led the IMO to encourage governments to ensure that cyber risks are appropriately addressed in safety management systems (SMS) as from January 1, 2021. The IACS plans to consolidate its set of rules in the coming months;

- ●a global move towards a “safety case” system, which is emerging for the offshore industry and requires the expertise of an independent verification body;

- ●Regulation (EU) No. 2015/757 of the European Parliament and of the Council of the European Union dated April 29, 2015 on the monitoring, reporting and verification (MRV) of carbon dioxide emissions from maritime transport, which came into force on July 1, 2015. Monitoring plans were submitted for verification in 2017 while emissions reports are to be submitted for verification in 2019. The IMO’s mandatory Data Collection System (DCS) for tracking the fuel oil consumption of ships was also introduced in 2019. The European Union’s efforts to align the two systems have led to moves to include the shipping industry in the EU’s emissions trading system. In this respect, the MRV regulation should be central to the implementation of the aforementioned new regulations included in the “Fit for 55”;

- ●the IMO Guidelines for Ships Operating in Polar Waters, or “Polar Code”, which came into effect on January 1, 2017. The IMO has also decided to ban the use of heavy fuel oil in the Arctic region as from January 1, 2024;

- ●Annex VI (amended) of the MARPOL convention, which reduced the maximum worldwide sulfur content of fuel oil used by ships to 0.50% (from 3.50% previously) as from January 1, 2020;

- ●even though the issue of ship automation has taken a backseat to environmental considerations in the various agendas, the IMO has continued its work of identifying issues that ships with varying degrees of automated processes raise with regard to current ship safety treaties. This work will continue over the next few years, with the aim of drawing up a specific body of regulations for this type of vessel.

New fuels and alternative propulsion solutions: technological challenges

After the Covid-19 pandemic had severely impacted the shipping market and led to a sharp drop in orders in 2020, the winter of 2020-21 and most of 2021 saw an increase of almost 100% (versus 2020) in orders for new vessels. This surge in new orders (driven by the increase in liquefied natural gas and container shipping) and the reduction in the prices applied by shipyards, which developed their LNG expertise in parallel for large vessels in order to limit CO2 emissions, have led to full order books for the largest shipyards. This resulted in an increase in shipyard prices at the end of 2021, and therefore in a fall in new orders from ship owners. Gas transportation, very large bulk carriers (such as newcastlemax and neo-panamax) and small container ships are still enjoying good momentum in terms of new orders. Other sectors are looking ahead to a rally in global transportation volumes.

The choice of future propulsion technologies amid increasingly strict regulations on reducing greenhouse gas emissions is a subject of increasing urgency within the industry. The deadlines set by the IMO (as from 2023, and then by 2030 and 2050), entail difficult decisions for ship owners, which either need to opt for solutions still being developed, or for solutions that are not wholly satisfactory and are based on inputs that are still unknown, particularly in terms of bunkering facilities for the new, cleaner fuels. In Asia, the recovery in economic activity and shipbuilding led to an upturn in certain segments as from the fourth quarter of 2020. The hard-hit passenger ship sector (cruise liners and ferries) is showing early signs of a recovery, like the tourism industry at large. Tanker and energy markets are also showing encouraging signs of an upturn. The key players in both of these segments – major liners and oil companies – have opted for LNG fuel, currently considered the best technology for the transition. Bureau Veritas has capitalized on its LNG leadership, offering its classification services for LNG carriers, bunker vessels and other LNG-fueled vessels.

Bureau Veritas has continued to capture market share and the entire existing fleet also continued to grow in all segments, underlining the Group’s operational excellence. In 2022, Bureau Veritas will continue to support its ship owner, shipyard and charterer clients in transitioning to cleaner energy, lending technical expertise to solutions for today’s and tomorrow’s world. On offshore markets, extreme volatility in oil prices has threatened the profitability outlook for many projects. The result has been a virtual freeze in FPSO and drilling rig orders. However, 2021 saw a significant rise in investments from incumbent oil companies in offshore wind farm projects, for both fixed and floating wind turbines.

Ship owners and offshore operators are increasingly concerned about sustainability, while at the same time having to control costs. Against this backdrop, Bureau Veritas is concentrating on three key areas:

Digitalization and the development of a strong value-added service offering

Digital innovations focused on performance

The digital revolution in the maritime industry is gathering momentum. Through its Digital Classification services, Bureau Veritas Marine & Offshore is reinventing the role of technology in the operating model for classifying its clients’ ships and offshore facilities. By leveraging digital twin, drone, remote virtual visit, artificial intelligence and cloud platform technologies, Bureau Veritas can help its clients make safer, more effective, data-driven decisions.

- ●3D classification is bringing the design review and monitoring process for the construction of new vessels and offshore facilities into the digital age using a 3D model. This eliminates the need for 2D drawings and offers a collaborative solution for users to interact directly with the 3D model. Ship owners, shipyards, ship designers and Bureau Veritas can therefore work more effectively across a collaborative platform to perform calculations, exchange updated information and address classification comments.

- ●Remote inspection techniques using smart devices such as drones, crawlers and remotely operated vehicles. On-board surveyors can safely inspect hazardous or difficult-to-access areas of ships, while ship owners and operators can reduce scaffolding costs and better anticipate the extent of repairs to be planned.

- ●Optimized and predictive survey schemes allowing clients to set up inspection programs based on an analysis of risks specific to their facility and equipment, and an in-service monitoring and maintenance program based on predictions of the operating condition of their equipment. In 2021, Bureau Veritas launched the first pilot of its “BV Machinery Maintenance” digital solution. This solution is designed to facilitate the implementation of maintenance plans for ship machinery, the in-service supervision of this maintenance and its continuous improvement throughout the ship’s operation. Based on real-time data, BV Machinery Maintenance offers clients time and cost efficiencies.

- ●Remote and augmented reality surveys use digital tools to help ship owners and operators perform eligible classification inspections in a safer, more flexible and effective manner by reducing logistics costs such as transport and on-board access preparation. The remote inspection solution rolled out by Bureau Veritas is based on virtual ship visits that do not require any specific on-board equipment. The Group has also reorganized its operating teams with the launch of a network of eight remote inspection centers.

A Green Line of services and solutions dedicated to the protection of the maritime environment and decarbonization

As a classification society, Bureau Veritas Marine & Offshore works with the shipping industry, from offshore operators to ship owners and port authorities. The Group is committed to reducing the environmental impact of its industry and supports its stakeholders in working towards their unique sustainability goals. Bureau Veritas helps its clients comply with environmental regulations, implement sustainable on-board solutions, and gauge their decarbonization progress, for example.

- ●developing and implementing rules and guidelines for new fuels and alternative propulsion solutions;

- ●validating the sustainable origins of alternative fuels;

- ●providing LNG expertise and project support;

- ●electrifying sea-going vessels;

- ●developing infrastructure for new fuels;

- ●onshore & offshore wind lifecycle solutions;

- ●engineering services for sustainability performance;

- ●sustainable construction in shipyards;

- ●marine pollution prevention;

- ●responsible fishing practices;

- ●ensuring the safety of the crew and passengers;

- ●on-board health, safety and hygiene protocols.

In 2021, Bureau Veritas Marine & Offshore launched its VeriSTAR Green platform. This online platform helps guide ship owners (who may or may not be BV customers) in managing and implementing IMO and EU energy efficiency regulatory requirements.

Partnering with our clients beyond the regulatory and compliance field

Developing strong value-added services remains an important growth driver for Bureau Veritas Marine & Offshore. These services are supported by major portfolios and brands, including Bureau Veritas Solutions Marine & Offshore, MatthewsDaniel and TMC Marine.

Bureau Veritas Solutions Marine & Offshore is a separate and independent organization providing clients with technical advice, particularly in terms of the energy transition. Since 2018, Bureau Veritas Solutions Marine & Offshore has reported growing demand for its services, as ship owners and operators look to experts to improve the performance of their assets. Bureau Veritas Solutions Marine & Offshore helps clients manage changes in regulations, particularly in the environmental field (energy transition, emissions monitoring, design support, project management support) and offers services during the shipbuilding phase (engineering, risk analysis) as well as during the asset lifecycle, using new digital tools.

2020 saw the launch of the BVS eAcademy online training platform and of the dedicated Bureau Veritas Solutions Marine & Offshore website.

-

1.6Accreditations, approvals and authorizations

To conduct its business, the Group has numerous licenses to operate “Authorizations”, which vary depending on the country or business concerned: accreditations, approvals, delegations of authority, official recognition, certifications or listings. These Authorizations may be issued by national governments, public or private authorities, and national or international organizations, as appropriate.

Marine & Offshore (M&O) division

The Group is a certified founding member of the International Association of Classification Societies (IACS), which brings together the 12 largest international classification societies. At European level, Bureau Veritas is a “recognized organization” under the European Regulation on classification societies and a “notified body” under the European Directive on marine equipment. Bureau Veritas currently holds more than 150 delegations of authority on behalf of national maritime authorities.

-

1.7Research and development, innovation, patents and licenses

As part of its research and innovation strategy, the Group carries out experimental development activities on strategic projects that aim to bolster its positioning or enable it to capture new markets.

- ●a research partnership with the French Alternative Energies and Atomic Energy Commission (CEA), with which projects are carried out each year on issues such as cybersecurity and IoT;

- ●contracts with innovative technology start-ups and industry players to develop common interest projects, such as artificial intelligence and blockchain;

- ●its involvement in the work of the European Cyber Security Organisation (ECSO) within the context of an EU-driven public-private partnership to define the technological roadmap for the cybersecurity sector;

- ●its partnership with industrial joint research centers like IRT Jules Verne and with academic laboratories such as that of École Centrale de Nantes for developing digital solutions for innovative hydrodynamic studies;

- ●its involvement in subsidized joint projects, notably those financed by the Single Interministerial Fund, and its replies to European calls for projects;

- ●its participation in the Hydrogen Council’s IECRE System, the IEC System for Certification to Standards Relating to Equipment for Use in Renewable Energy Applications;

- ●the shift of its businesses and solutions to digital media, with the development of future inspectors and auditors and inspection/audit services.

The Group is eligible for the research tax credit in France within the framework of its business activities. This tax credit is similar to a subsidy in that it is refundable even if it exceeds the amount of tax payable. Accordingly, it is included in current operating profit.

-

1.8Information systems

- ●defining the Group’s technological architecture by outlining the standards applicable to all businesses and regions in terms of software application development and network infrastructure;

- ●selecting, implementing, deploying and maintaining integrated cross-functional solutions in all operating units (email, collaboration tools, ERP finance, client relationship management, Human Resources and production systems, etc.);

- ●guaranteeing the availability and security of the infrastructure and integrated solutions used by the Group; and

- ●managing the Group’s overall relationship with its main suppliers of equipment, software and telecommunications services.

The department is organized into six Regional Shared Services Centers, covering North America, Latin America, Europe, France/Africa, Asia and the Middle East/Pacific. These shared services centers provide different support services (network, help desks, hosting, support, etc.) to countries in their respective regions.

A Global Shared Services Center has also been set up in Noida (India) with the aim of pooling certain cross-functional operational support processes.

In 2021, operating expenses and running costs for the Group’s information systems represented around 3% of the Group’s consolidated revenue.

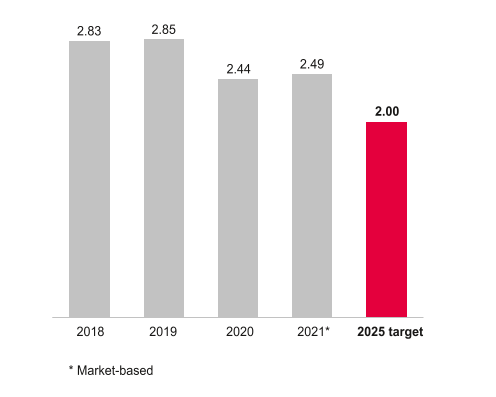

1)After the June 2013 four-for-one stock split.2)Source: 2018 Revision of the World Urbanization Prospects, published by the Population Division of the United Nations Department of Economic and Social Affairs (DESA).3)Wearable technology denotes an item of clothing or an accessory incorporating smart devices. Wearables are part of the SmartWorld. They are everyday objects used to detect, analyze and transmit information on body signals to the wearer.4)Adjusted operating margin at constant currency.5)Net cash generated from operating activities/Adjusted Operating Profit, on average for the period.6)TAR: Total Accident Rate (number of accidents with and without lost time x 200,000/number of hours worked).7)Proportion of women from the Executive Committee in Band II (internal grade corresponding to an executive management position) in the Group (number of women on a full-time equivalent basis in a leadership position/total number of full-time equivalents in leadership positions).8)Greenhouse gas emissions from offices and laboratories, tons of CO2 equivalent net emissions per employee and per year corresponding to Scopes 1, 2 and 3 (emissions related to business travel).9)Protection & Indemnity. -

Corporate Social Responsibility

-

2.1The Bureau Veritas commitment – Shaping a Better World

2.1.1Mission statement

Since 1828, we have acted as trust makers between companies, governments and society. We are independent, impartial guarantors of our clients’ word.

Identity

Bureau Veritas is a world leader in laboratory testing, inspection and certification services. Created in 1828, the Group has close to 80,000 employees located in nearly 1,600 offices and laboratories across the globe. Bureau Veritas helps its clients improve their performance by offering services and innovative solutions in order to ensure that their assets, products, infrastructure and processes meet standards and regulations in terms of quality, health and safety, environmental protection and social responsibility.

Bureau Veritas is a Business to Business to Society service company that contributes to positively transforming the world we live in. We work closely with our clients to address the critical challenges they face and to link these to the emerging aspirations of society. We play a pivotal role in building and protecting companies’ reputations, supporting them as they forge the foundations of trust that is built to last.

Manifesto

Trust is the very foundation upon which relationships between citizens, public authorities, and companies are built. In today’s fast-changing world, this essential link is no longer a given.

Citizens and consumers are seeking out verified and verifiable information on how companies develop, produce and supply their goods and services. Decision makers across all organizations face the challenge of proving their CSR commitments in order to remain competitive and sustainable.

At Bureau Veritas, our work enables organizations to operate and innovate safely and perform better. Thanks to our unrivaled expertise, technical knowledge and worldwide presence, we support them by managing quality, safety, health and sustainability risks, to the benefit of society as a whole.

As a Business to Business to Society company, we believe that today more than ever, trust depends on evidence of responsible progress.

We bring more to the table than testing, inspection and certification. The work we do goes beyond verifying compliance and has a much wider impact.

We play a pivotal role in building and protecting companies’ reputations, supporting them as they forge the foundations of trust that is built to last.

Vision

Our employees serve our clients and are inspired by society; they make Bureau Veritas a Business to Business to Society service company that contributes to positively transforming the world we live in.

Mission

-

2.2Sustainability risks and opportunities

Sustainability risks and opportunities are analyzed through a process set by the Group’s Risk department. Some 40 risks and opportunities were identified using a bottom-up approach drawing on the expertise of operating and support departments. These were then assessed by impact (financial, human, business, environmental and reputational), occurrence and means for reducing them.

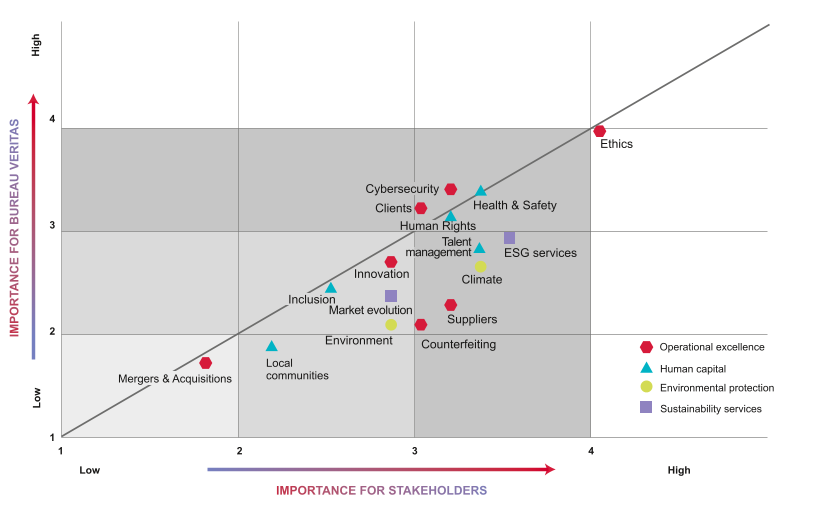

Sustainability risks are included in this analysis. The CSR Steering Committee took part in the selection process. A total of 13 sustainability risks were identified. These have been reviewed by the External CSR Focus Committee. Their findings are shown in the materiality matrix below.

The risks identified were reviewed first by the Audit & Risk Committee, and then by the Board, to oversee implementation of appropriate policies on reducing impacts and frequency, and improving control methods.

2.2.1Materiality matrix

-

2.32025 CSR strategy

2.3.1Strategic focuses and priorities

The Bureau Veritas CSR strategy was drawn up by the Group CSR department with active participation from the CSR Steering Committee representing each of the support functions in charge of one or more ESG topics.

Liaison with the Group Strategy department ensured that the CSR strategy was consistent with Bureau Veritas’ corporate strategy. The CSR strategy was submitted first to the Bureau Veritas Chief Executive Officer, then to the Strategy Committee of the Board of Directors, and finally to the Group Executive Committee.

The CSR department took charge of CSR strategy rollout across all operating groups, each setting priorities and goals on the basis of its own particular situation assessment. Action plans were drawn up with each operating group and for each region where necessary. The action plans were determined on the basis of three key factors:

- ●the degree of maturity of the local CSR management system. This is gauged by means of a “sustainability index”, attributed by self-assessment of the implementation of Bureau Veritas’ CSR policies (see 2.3.2);

- ●the performance of the local CSR management system. This is gauged by means of 19 key indicators used by the Group to monitor implementation of the CSR strategy and the achievement of objectives;

- ●local CSR cultural and regulatory characteristics.

- ●monthly by each manager, using the Clarity solution to track the 19 key indicators and progress on the action plans;

- ●quarterly, under the Operating Reviews carried out by each operating group;

- ●annually, by the Chief Executive Officer at the management review held during the first quarter.

The Board of Directors is informed on the implementation of the CSR strategy at least once a year, and the Group Strategy Committee and the Audit & Risk Committee more regularly. The Strategy Committee monitors implementation of the CSR strategy and determines whether it needs to be adjusted to take into account any new regulatory requirements or stakeholder expectations. The Audit & Risk Committee monitors the data reporting process and the consistency and reliability of indicators.

2.3.1.1Priorities

- ●Bureau Veritas’ ESG services offering addressing needs emerging from clients’ environmental and social transitions. This is outlined in sections 2.7.2 – The BV Green Line of services and solutions, and 2.7.3 – Market changes in CSR. It reflects the Group’s business strategy;

- ●corporate social and environmental responsibility, which is reflected in Bureau Veritas’ implementation of sustainable policies to meet stakeholder expectations. This is outlined in sections 2.4.1 to 2.6.3, and detailed in the Group CSR strategy.

Through its mission and commitment, Bureau Veritas is “Shaping a World of Trust”. The Group’s sustainable development strategy is fully integrated into this objective, with the aim of “Shaping a Better World”. It is built upon three strategic axes:

- ●“Shaping a Better Workplace”;

- ●“Shaping a Better Environment”;

- ●“Shaping Better Business Practices”.

The strategy focuses on five of the UN’s Sustainable Development Goals (SDGs) and is based on three sustainability pillars: “Social & Human capital”, “Natural capital” and “Governance”. The CSR strategy addresses 20 priority subjects, as presented below.

Social & Human capital

Occupational health and safety

Human rights

Access to quality essential healthcare services

Employee volunteering services

Equal remuneration for women and men

Diversity and equal opportunity

Workplace harassment

Proportion of women in leadership and other positions

Employment

Non-discrimination

Capacity building

Availability of skilled workforce

Natural capital

Energy efficiency

GHG emissions

Risks and opportunities due to climate change

Governance

Effective, accountable and transparent governance

Anti-corruption

Product and quality compliance

Client privacy & cybersecurity

Responsible sourcing & supplier ethics

2.3.1.2Management

For Group-wide policies, the strategy is managed jointly by the Group’s Sustainable Development department and CSR department, with support from the CSR Steering Committee. The implementation of CSR policies in operations is managed by the CSR departments of the operating groups.

All of the CSR policies under this strategy are covered by the management system, which is audited regularly by internal audits of the QHSE department on Quality, Health & Safety, Security and Environment. CSR topics to which the Group wishes to pay particular attention are added to the audit questionnaire of the Internal Audit teams.

-

2.4Governance and operational excellence – Shaping Better Business Practices

2.4.1Ethics

Background

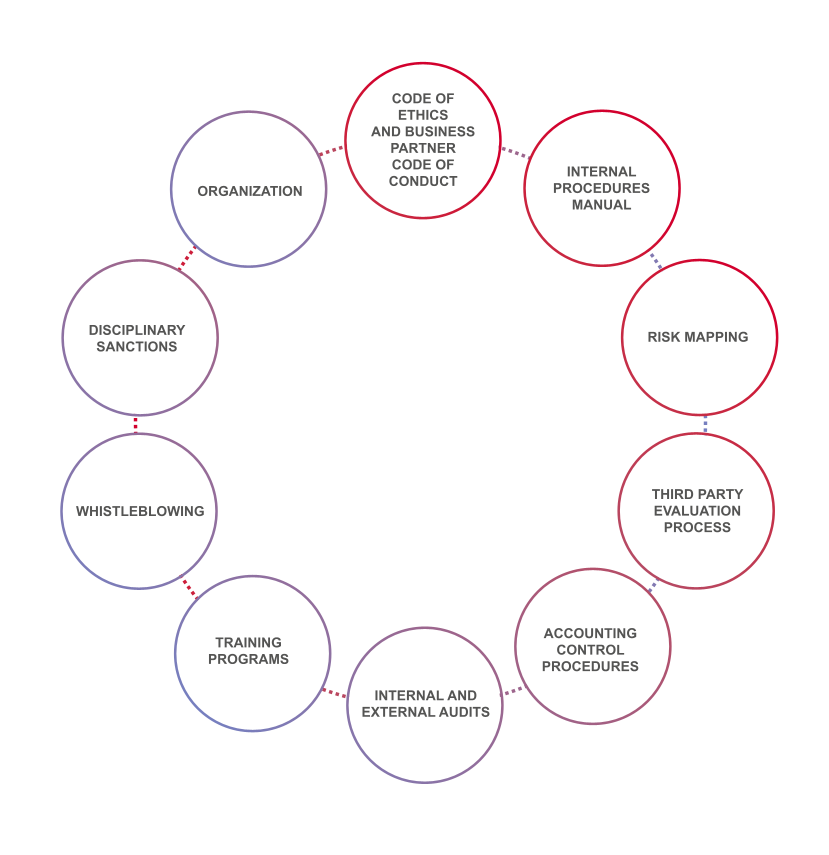

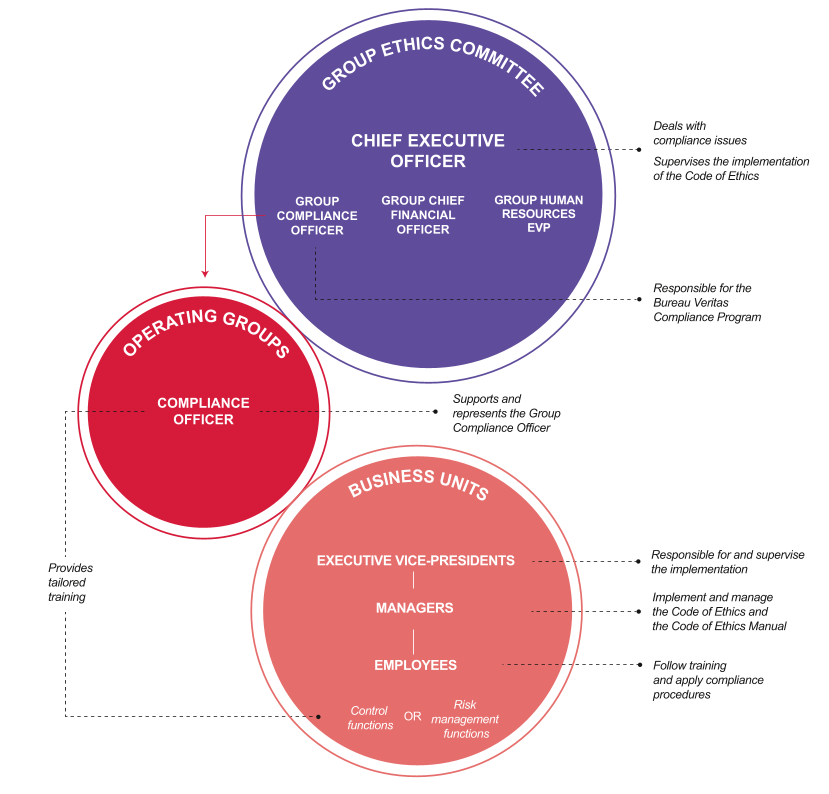

Bureau Veritas’ business inherently requires independence, impartiality and integrity. For this reason, ethics is one of the Group’s three “Absolutes”.

The Ethics absolute covers four major principles, set out in a Code of Ethics. These include a commitment to combat corruption. Because of its broad geographical coverage and its business of second- or third-party testing, inspection and certification, Bureau Veritas is potentially exposed to passive corruption risks in the countries most prone to this phenomenon. All corruption and influence-peddling risks are identified in a specific map, which was updated in 2021 (the previous update being in 2019).